Explain Why a Difference Occurs in the Unit Costs

Budget reserves are established to cover identified risks that occur while implementing a project work package or activity. The resulting number is the selling price of the product.

Gross Vs Net Revenue Difference Importance And More Bookkeeping Business Money Management Accounting And Finance

Total costs to be allocated under the FIFO method only includes the Monthly expenses incurred.

. An organization cannot practice both the approaches at the same time while the two methods absorption costing and variable costing carry their own advantages. Cost-plus pricing is also known as markup pricing. Economics is everything to do with money The statement is Does a decision to go to college have anything to do with expanding choices or reducing scarcity.

On the contrary when a lesser number of units are produced the fixed cost per unit increases. The following are the main differences between Cost Control and Cost Reduction. This variability of fixed cost per unit creates problems in product costing.

Next lets look at why it is important. Its a pricing method where a fixed percentage is added on top of the cost it takes to produce one unit of a product unit cost. These costs are usually only classified as direct or indirect costs if they are for production.

Exhibit 23 shows the behaviour of fixed costs in total and on a per unit basis. Consumers can enjoy lower prices. What is Diminishing Marginal Returns.

The ABC system began in 1981 whereas TCA methods were designed and developed between 1870 to 1920. This is the primary difference between variable and absorption costing. 20000 5000.

THE WEIGHTED-AVERAGE METHOD ALLOCATES THE VALUE OF BEGINNING LAST MONTHS ENDING WIP. Therefore the marginal cost to produce the additional water bottles 450unit is less than the marginal benefit a customer is expected to receive 5500. Notice that the fixed manufacturing overhead cost has not been included in the unit cost under variable costing system but it has been included in the unit cost under absorption costing system.

The lower inventory carrying amounts are used for the cost of sales while the sales are reported at current prices. While the direct costs per unit are easy to find the indirect costs are less noticeable. The essential difference between direct costs and indirect costs is that only direct costs can be traced to specific cost objects.

This difference occurs as absorption costing treats all variable and fixed manufacturing costs as product cost while variable costing treats only the costs that vary with the output as product cost. Cost Control is a temporary process in nature. Under this concept costs are accumulated over a fixed period of time.

When a greater number of units are produced the fixed cost per unit decreases. Key Difference Actual Cost vs Standard Cost. The economy grows as lower prices stimulate increased demand.

This increase in gross profits will occur because of the lower inventory carrying amounts of the liquidated units. The larger the business non-profit or government the lower its per-unit costs. Project success is decided by how well the project cost has been handled in the project.

Explain the difference between budget reserves and management reserves. In other words the cost of each product produced is assumed to be the same as the cost of every other product. THE FIFO METHOD ONLY ALLOCATES EXPENSES INCURRED THIS MONTH.

As a result the firm will have to uncover indirect product costs through a costing methodologyeither traditional cost allocation or Activity Based costing. Now you have an understanding of what is project cost. No project starts without a budget.

Unlike Cost Reduction which is a permanent process. The gross profit on these units is higher than the gross profit that would be recognized using more current costs. 5 4 1 10.

What is the difference between a quantity and a unit. Only costs from this month are used to calculate Cost per. Many times it happens that the project may not be completed within the project cost.

June 25 2021. ABC vs Traditional Costing. - shipping - marketing - raw materials - human sources.

The reason why the intersection occurs at this point is built into the economic meaning of marginal and average costs. This pricing method looks solely at the unit cost and ignores the prices set by competitors. If the risk does not materialize the funds are.

The first difference between says that Cost Control focuses on decreasing the total cost while cost reduction focuses on decreasing per unit cost of a product. If you are working science or math problems the answer to this question is that quantity is the amount or numerical value while the unit is the measurement. The 7 most important differences between cost control and cost reduction are explained here.

Thus optimal quantity produced should be at MC MR. The key difference between actual cost and standard cost is that actual cost refers to the cost incurred or paid whereas standard cost is an estimated cost of a product considering the material labor and overhead costs that should. For example if a sample contains 453 grams the quantity is 453 while the unit is grams.

At B Marginal Cost Marginal Revenue then for each extra unit produced the cost will be higher than revenue so that you will create less. Economies of scale also give a competitive advantage to large entities over smaller ones. Cost that occurs after delivery or shipment of product to customer.

List the five subsystems associated with a styrene process unit. A cost object is something for which a cost is compiled such as a product service customer project or activity. In the TCA system the cost objects and used up resources are required to evaluate the.

Cost Control focuses on decreasing the total cost of production while cost reduction focuses on decreasing per unit cost of a product. Explain why continuous improvement is needed to reduce or eliminate waste. Diminishing marginal returns is a theory in economics that states if more and more units of a variable input are applied when other inputs are held constant the returns from the variable input may decrease eventually even though there is an initial increase.

At A Marginal Cost. Why it is important. Actual cost and standard cost are two frequently used terms in management accounting.

The difference between ABC or Activity Based Costing and TCA or Traditional Cost Accounting is that ABC is complex whereas TCA is simple. Direct costs are the same under both traditional costing and ABC. Memorize flashcards and build a practice test to quiz yourself before your exam.

This is also known as principle of diminishing marginal productivity. The marginal cost line intersects the average cost line exactly at the bottom of the average cost curvewhich occurs at a quantity of 72 and cost of 660 in. Process costing is used when there is mass production of similar products where the costs associated with individual units of output cannot be differentiated from each other.

Start studying the Econ 2302 flashcards containing study terms like Evaluate the statement.

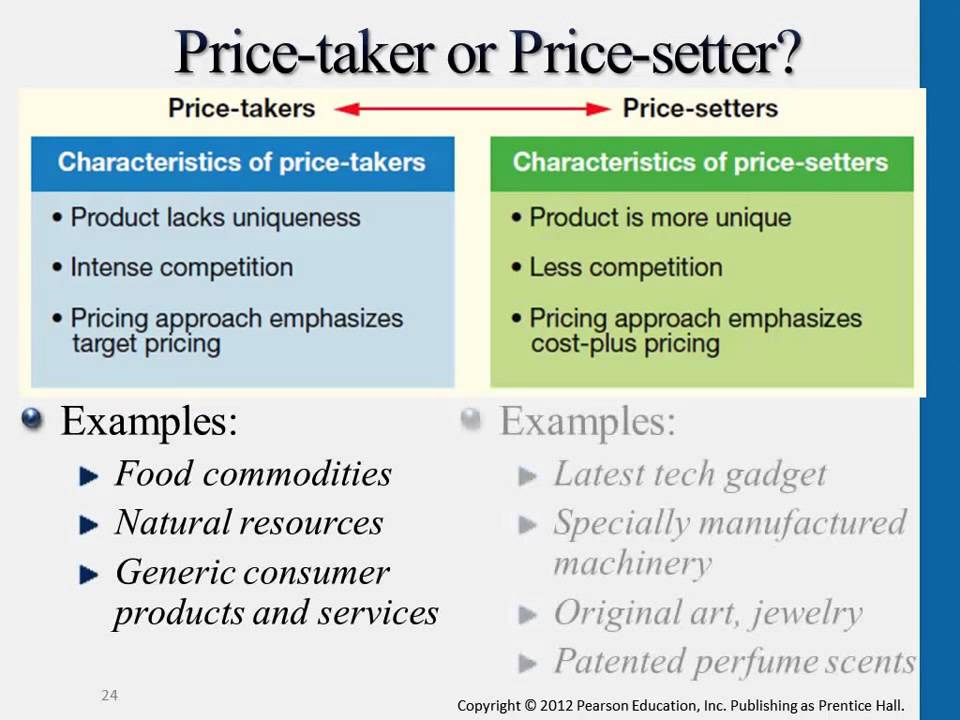

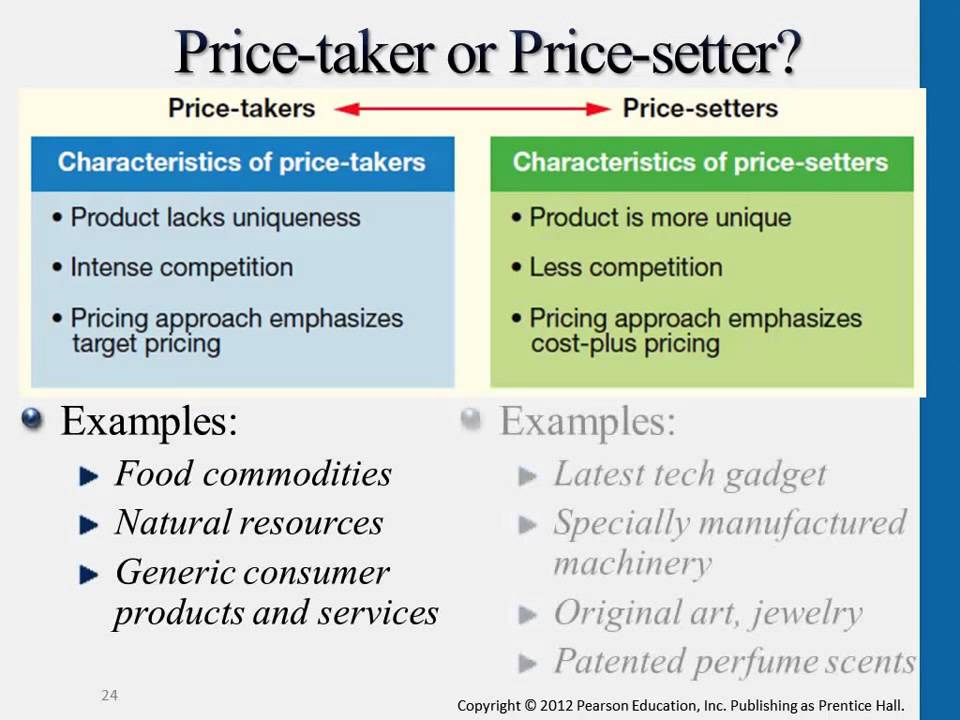

This Video Gave A Good Example Of Price Takers And Price Setters I Found The Examples Given Make It More Relatable Latest Tech Gadgets Relatable Tech Gadgets

Breakeven Pricing Meaning Importance Advantages And More Money Strategy Learn Accounting Financial Analysis

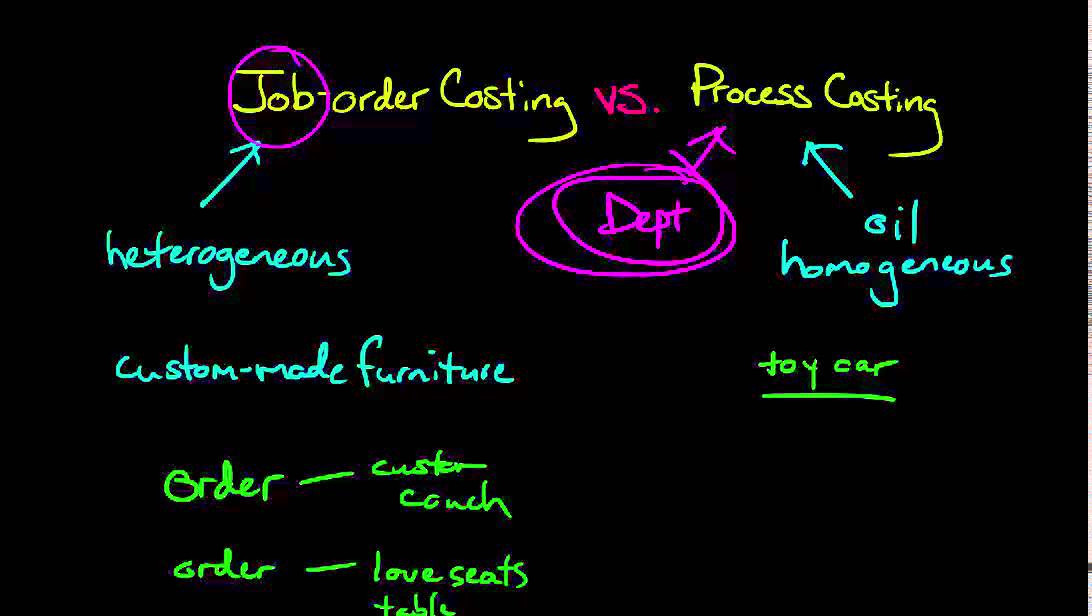

Tsedenya Gebreyesus In This Video He Explains And Goes Into Details About The Differences Of Job Order Costing And Process Costing He Job Relatable Process

Comments

Post a Comment